Poland has grown into a dynamic hub for medical equipment, pharmaceuticals, and MedTech innovation. With a population of nearly 38 million and a low unemployment rate, the country has become the sixth-largest economy in the European Union. Foreign investors are drawn by its skilled workforce, relatively modest labour costs, central location, and access to the EU single market.

This report provides an up-to-date overview of Poland’s medical and pharmaceutical industries, summarising their size, geographical concentration, trends, development trajectory, and the challenges they face. The aim is to help international business owners understand where opportunities lie and how to navigate this rapidly evolving landscape.

Medical devices and pharmaceuticals

Poland’s medical devices industry is remarkably diverse. According to a 2024 report by the Polish Agency for Enterprise Development, the sector consists of around 5,000 entities spanning manufacturers, importers, and distributors. About 300 firms are manufacturers and the sector employs around 30,000 people. The domestic market was valued at roughly €4.2 billion in 2020 and more than 60 % of revenues come from exports.

Most companies are SMEs founded in the late 20th century, but the last decade has seen the emergence of around 150 MedTech start-ups that combine AI, robotics, and digital health solutions. Rising healthcare spending—PLN 205.6 billion in 2022 (6.7 % of GDP)—and an ageing population underpin market growth.

The pharmaceutical industry is another flagship sector. INFARMA estimates that around 350 companies operate in Poland, including about 80 firms with more than ten employees and roughly 130 that export their products. The industry’s value added is around €2.5 billion (0.4 % of GDP), with nearly 65 % of firms reporting innovation activities. The workforce is sizable, estimated at 80,000–100,000 employees.

Exports more than doubled between 2010 and 2023, from under €2 billion to nearly €4.9 billion. Yet Poland remains a net importer, with 62 % of the sector under foreign capital. Key challenges include reliance on imported raw materials and the need to expand domestic production capacity.

Wholesale pharmaceutical market

Wholesale distribution is a highly regulated subsector. By the end of 2023, official statistics counted 336 companies with more than nine employees, including 117 with more than 49 employees. The national register lists 1,080 licensed wholesalers, though only 406 remain active.

The market is extremely concentrated: the ten largest distributors cover about 95 % of pharmacy deliveries and 70 % of hospital deliveries. In early 2025, leading distributors formed the Polish Pharmaceutical Distribution Association, representing over 70 % of market share.

Despite slower sales growth in 2024 (7.6 % vs. 13 % in 2023), the sector’s gross profit margin rose to 4.8 % and 88 % of companies were profitable. Risks remain, however, particularly late payments from hospitals and pharmacies, which can undermine liquidity.

Export leadership & upgrading in medtech & pharma

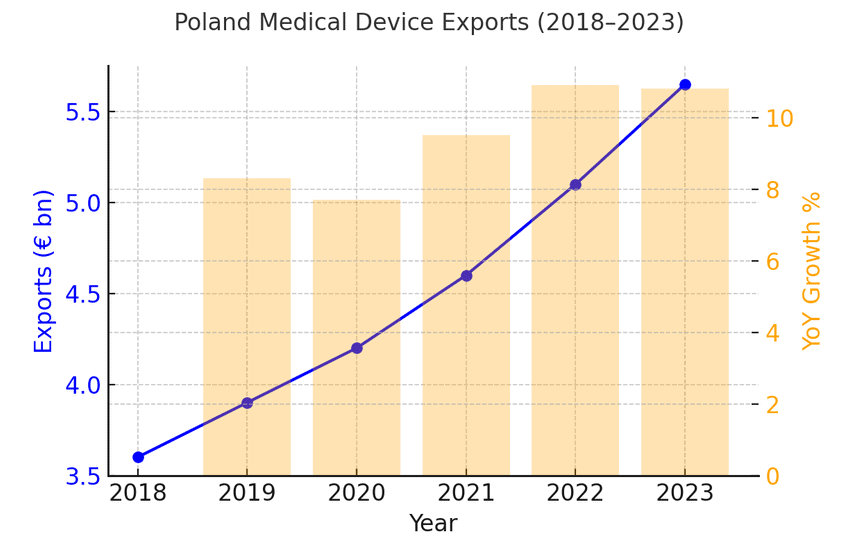

In 2023, Poland exported medical devices and equipment worth €5.65 billion—a new record high. In the first eleven months of 2024, exports already reached €5.37 bn, indicating continued strength.

In the pharmaceutical field, exports in 2023 reached €4.8 billion, up ~9 % year-on-year.

The medical devices segment accounted for about 1.6 % of Poland’s total exports in 2023. Between 2018 and 2023, the medtech export CAGR was ~9.3 %. In an optimistic scenario, exports could reach €9.4 billion by 2028.

Poland is gradually moving up the value chain—from low-end consumables to high-end diagnostics, imaging, monitoring, and niche instrumentation.

Implication for investors: A foreign firm entering Poland in medtech or pharma should aim at higher-tech segments—connected devices, diagnostics, AI-enabled equipment—rather than commodity generics.

Workforce trends & demographic pressures

The pharma and MedTech industries employ over 110,000 people, but demographic headwinds loom. A declining birth rate, an ageing population, and emigration reduce the pool of young talent.

To compensate, many companies hire from abroad or leverage hybrid work. Competition from Western Europe and Asia for high-skill labour pushes up salary baselines. Upskilling, reskilling, and retention are now key investments.

Regulatory & compliance environment

The EU’s AI Act is nearing enforcement, which affects AI-powered medical devices and software. Pharma and medical-device firms must align with stringent EU MDR/IVDR regulations, covering certification, post-market surveillance, and labelling.

Noncompliance risks are significant, and firms must embed compliance teams from day one. In wholesale pharma, delayed payments from hospitals remain a structural risk—credit risk modelling and factoring may be needed.

Disruptors and digital health convergence

Telemedicine, remote monitoring, wearable devices, point-of-care diagnostics, and AI-assisted imaging are converging industries. Companies combining medtech, software, and services may capture more value.

Health data interoperability (FHIR, HL7) is gaining traction, and firms integrating with hospital IT systems will have an edge. Partnerships with academic medical centres can accelerate validation and adoption, with Poland serving as a manageable test market before scaled rollouts.

Conclusion

Poland offers a compelling mix of opportunity and challenge in the medical and pharmaceutical fields.

-

Medical devices & pharma – export-driven, innovative, but reliant on imports

-

Wholesale pharma – profitable but concentrated and exposed to liquidity risks

-

Regulation – strict, requiring strong compliance from day one

-

Digital health – a fast-growing opportunity with global relevance

For international business owners, Poland represents one of Europe’s most dynamic healthcare markets. Strategic entry, strong local partnerships, and careful risk management will be key to success.

Sources

-

PARP – The Medical Devices and Pharma Sector in Poland Report 2024

-

INFARMA, Statistics Poland

-

BOŚ Bank – Raport: Hurt farmaceutyki 2025.04

-

KPMG – AI Trust in Poland 2025

Dominik Wantuch

I am dedicated to facilitating your entry into the Polish market. At Architecture of Sales, my team and I are committed to enhancing your visibility and boosting sales in Poland through the following strategies:

- Market Validation Activities - We conduct comprehensive market research, analysis, SWOT assessments, competitor evaluations, and direct customer interviews to validate your market approach.

- Lead Generation - Utilizing both outbound and inbound methods, including various Sales Development Representative (SDR) prospecting techniques, we generate high-quality leads to drive your sales pipeline.

- Sales and Marketing Support - Acting as your local sales and marketing department, we adeptly represent your brand to customers, providing comprehensive support to strengthen your market position.

- Business Partner Identification - Whether identifying a local partner or developing an effective affiliate program, we assist in establishing valuable collaborations to optimize your market presence.

While our primary focus is on B2B SaaS companies, we are also open to collaborating with hardware-selling enterprises. For instance, we have successfully sold SaaS solutions, including ERP systems, to diverse sectors such as manufacturing, construction, retail, IT, HR, and EHS management.

Newsletter

Subscribe for more

Subscribe to our newsletter to get unique insights into the Polish market.

No strings attached, you can unsubscribe anytime. For more details, review our Privacy Policy.